Investing In Online Gambling Stocks

- Investing In Online Gambling Stocks Against

- Us Online Gambling Stocks

- Investing In Online Gambling Stocks 2020

- Gambling Stocks

- Investing In Online Gambling Stocks To Buy

Casino stocks can be extremely volatile, and understanding how an investment can be a big winner or loser is key to investing in the industry. Evaluate whether regional dynamics will cause a rise. Jan 10, 2020 Ladbrokes – GP.22 This is another gambling stock that you can invest in that is on the London Stock Exchange. It is a benchmark in the United Kingdom when it comes to online betting. Next up on this list of gambling stocks to buy is Golden Nugget Online Gaming, a market-leading iGaming platform which has recently hit the public markets through a reverse merger with blank-check.

In an interview with MarketWatch in 2002, the late Hunter S. Thompson said the only stock he ever bought was in the Boston Celtics. But in 2020, perhaps Thompson might reconsider, since the hot trend appears to be US online gambling operators becoming publicly traded companies.

Everything came to a roaring halt when the coronavirus ravaged the US. Sports and sports betting were all but nonexistent. It started with March Madness and then spread like a fever to other leagues. By April, your betting options were Russian table tennis and Belarusian soccer. When the US Supreme Court put an end to the Professional and Amateur Sports Protection Act (PASPA), it unknowingly opened the doors to gambling talks inside state capitals.

But in the last few months, it’s not the legalization of sports betting that’s been receiving widespread attention, but rather, well-established gaming companies taking their online business public. Online casinos are making record profits during the pandemic, and a few significant companies are pouring investment money into online segments, betting on long-term gains.

However, investing in online gambling can be just as rewarding as betting on the Boston Celtics to sweep the lifeless Philadelphia 76ers. It can also be as dangerous as betting on them to do it again against a more formidable foe.

Here’s a look at three high-profile companies leading the charge.

DraftKings leading the crusade

/gamble-5bfc3774c9e77c00587a1cfc.jpg)

This all started in April when popular daily fantasy sports (DFS) turned sports betting operator DraftKings (DKNG) debuted on Wall Street. The company’s opening price of $20.49 rose to an all-time high of $44.70 and is currently hovering around $38.91 as of 10:26 CST.

The company is known to suck the air out of a room. DraftKings Sportsbook is the leading sports betting operator, and whenever it does something as drastic as becoming a publicly traded company, others pay attention.

In its most recent earnings report, DraftKings said, “The company is well-positioned to continue to deliver on its key priorities, which include entering new states at the earliest opportunity, investing in product and technology to create new offerings for American sports — and acquiring and retaining customers.”

Investing In Online Gambling Stocks Against

We don’t need to sit here and ramble on about the inner workings of DraftKings. The company knows DFS, it knows sports betting, it has a huge customer base and it has the potential to become sports betting/online gambling royalty. It is also in online casinos now.

The level of success DraftKings has been able to achieve in the two years since the repeal of PASPA is unmatched. But in doing so, it placed a giant target on its back, with other operators looking to overtake the behemoth.

Golden Nugget is a leader in online casino gaming

Sometimes, when you have a game plan, you want it to be a secret — like when the Arkansas Razorbacks unveiled the Wildcat formation to utilize their three-headed monster, running backs Darren McFadden, Felix Jones and Peyton Hillis. Not only did they take other teams by surprise, but Arkansas also managed to finish the ’06 season 10-4.

This was not the case for Golden Nugget — no secrets here. The company revealed its strategy to break off its online gambling arm and list it on the Nasdaq exchange.

Golden Nugget is the largest online casino in New Jersey and posted a net income of $11 million in 2019. The company also plans to launch online casino games in Pennsylvania and Golden Nugget sportsbook in Michigan in 2021.

In a transaction plan similar to DraftKings’, Golden Nugget’s online gambling business will be acquired by Landcadia II, a publicly listed special purpose acquisition company (SPAC).

Once the deal is complete, Landcadia II will change its name to Golden Nugget Online Gaming Inc. (GNOG).

The move is genius. What Golden Nugget does best is online casino games. When it becomes a publicly traded company, owner Tilman Fertitta can raise additional funds at a time when COVID-19 has crippled land-based operations.

In football terms, this move screams “We are going to run the ball right down your throat — try to stop us.”

Rush Street Interactive taking a page from its rival DraftKings

If it works for your competitor, it just might work for you. That appears to be the mindset of Chicago-based Rush Street Interactive, as it too will become a publicly traded company once its deal with dMY Technology Group is complete.

Rush Street has a tally of first-to-market achievements under its belt. It was the first company to launch online casino gaming in New Jersey and the first to launch online sports betting in Pennsylvania, Indiana, Colorado and Illinois.

According to the Chicago Business Journal, the transaction value of the combined companies will be around $1.78 billion. Once the transaction is complete, dMY Technology will change its name to Rush Street Interactive Inc. (RSI).

Us Online Gambling Stocks

The move is not surprising and is a product of a rapidly changing industry looking to compete with top operators like DraftKings and FanDuel.

MGM Resorts and the value of investment

Lastly, we have MGM Resorts and the 10-figure investment from billionaire Barry Diller due to the outlook on online gambling. Diller’s company, InterActive Corp, purchased a 12% stake in MGM worth around $1 billion.

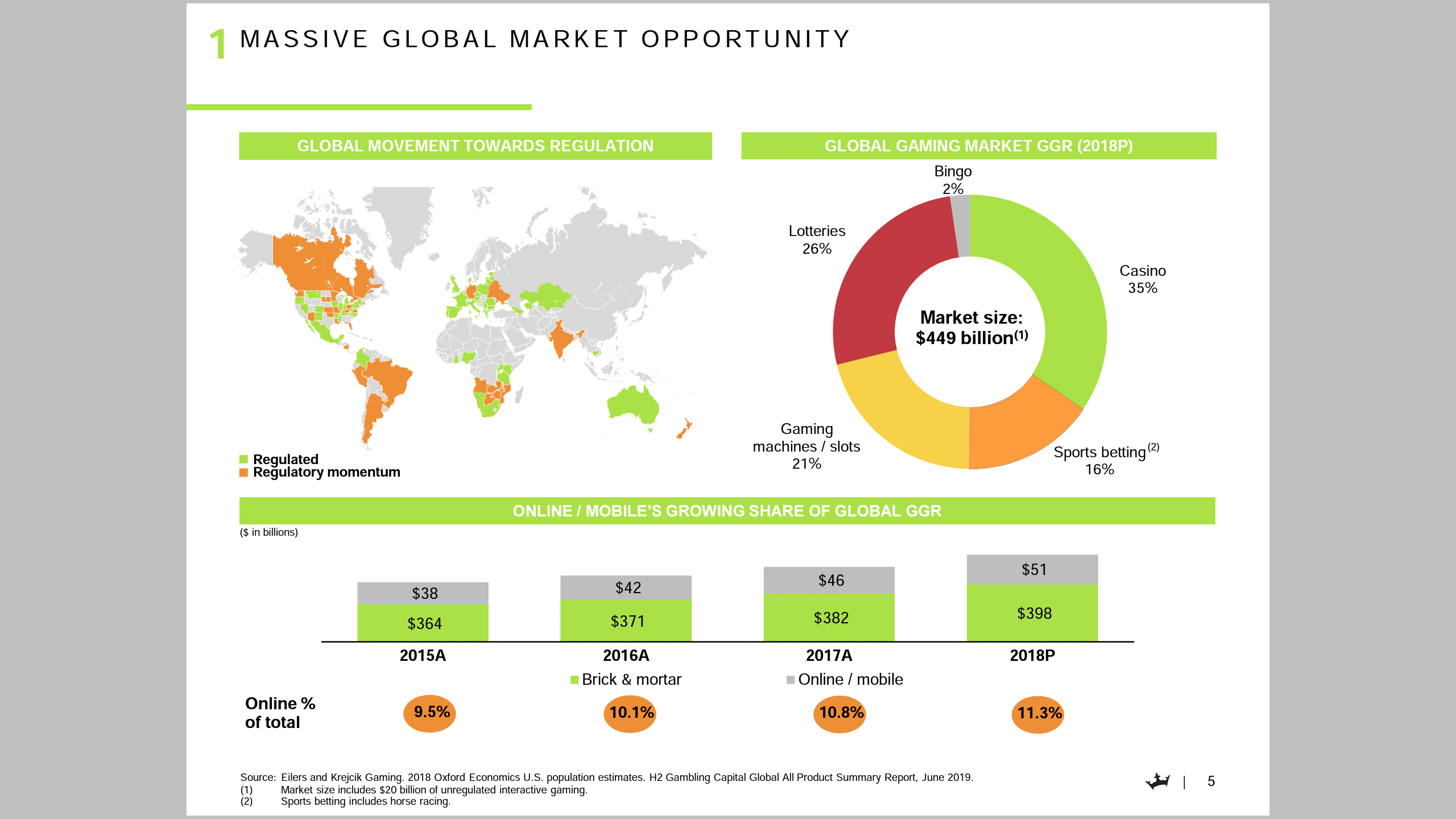

In a Fox Business report, Diller said the online gambling industry is worth $450 billion on a global scale and he has been looking to enter the online space for some time.

Investing In Online Gambling Stocks 2020

The substantial investment helps reinforce the narrative that online gambling is where the industry is heading. New Jersey online casinos recorded $84.9 million in revenue for June. Pennsylvania netted $55.8 million, and some market analysts anticipate Michigan’s online gambling value to be worth more than either of them.

The US stock market is extremely volatile and continuously in flux. To that extent, it might be wise to stick with Thompson’s advice and back the Celtics. They swept Philly 4-0 and now take on the defending NBA ChampionToronto Raptors in a best-of-seven series beginning Thursday, Aug. 27.

In an interview with MarketWatch in 2002, the late Hunter S. Thompson said the only stock he ever bought was in the Boston Celtics. But in 2020, perhaps Thompson might reconsider, since the hot trend appears to be US online gambling operators becoming publicly traded companies.

Everything came to a roaring halt when the coronavirus ravaged the US. Sports and sports betting were all but nonexistent. It started with March Madness and then spread like a fever to other leagues. By April, your betting options were Russian table tennis and Belarusian soccer. When the US Supreme Court put an end to the Professional and Amateur Sports Protection Act (PASPA), it unknowingly opened the doors to gambling talks inside state capitals.

But in the last few months, it’s not the legalization of sports betting that’s been receiving widespread attention, but rather, well-established gaming companies taking their online business public. Online casinos are making record profits during the pandemic, and a few significant companies are pouring investment money into online segments, betting on long-term gains.

However, investing in online gambling can be just as rewarding as betting on the Boston Celtics to sweep the lifeless Philadelphia 76ers. It can also be as dangerous as betting on them to do it again against a more formidable foe.

Here’s a look at three high-profile companies leading the charge.

DraftKings leading the crusade

This all started in April when popular daily fantasy sports (DFS) turned sports betting operator DraftKings (DKNG) debuted on Wall Street. The company’s opening price of $20.49 rose to an all-time high of $44.70 and is currently hovering around $38.91 as of 10:26 CST.

The company is known to suck the air out of a room. DraftKings Sportsbook is the leading sports betting operator, and whenever it does something as drastic as becoming a publicly traded company, others pay attention.

In its most recent earnings report, DraftKings said, “The company is well-positioned to continue to deliver on its key priorities, which include entering new states at the earliest opportunity, investing in product and technology to create new offerings for American sports — and acquiring and retaining customers.”

We don’t need to sit here and ramble on about the inner workings of DraftKings. The company knows DFS, it knows sports betting, it has a huge customer base and it has the potential to become sports betting/online gambling royalty. It is also in online casinos now.

The level of success DraftKings has been able to achieve in the two years since the repeal of PASPA is unmatched. But in doing so, it placed a giant target on its back, with other operators looking to overtake the behemoth.

Golden Nugget is a leader in online casino gaming

Sometimes, when you have a game plan, you want it to be a secret — like when the Arkansas Razorbacks unveiled the Wildcat formation to utilize their three-headed monster, running backs Darren McFadden, Felix Jones and Peyton Hillis. Not only did they take other teams by surprise, but Arkansas also managed to finish the ’06 season 10-4.

This was not the case for Golden Nugget — no secrets here. The company revealed its strategy to break off its online gambling arm and list it on the Nasdaq exchange.

Golden Nugget is the largest online casino in New Jersey and posted a net income of $11 million in 2019. The company also plans to launch online casino games in Pennsylvania and Golden Nugget sportsbook in Michigan in 2021.

In a transaction plan similar to DraftKings’, Golden Nugget’s online gambling business will be acquired by Landcadia II, a publicly listed special purpose acquisition company (SPAC).

Once the deal is complete, Landcadia II will change its name to Golden Nugget Online Gaming Inc. (GNOG).

The move is genius. What Golden Nugget does best is online casino games. When it becomes a publicly traded company, owner Tilman Fertitta can raise additional funds at a time when COVID-19 has crippled land-based operations.

In football terms, this move screams “We are going to run the ball right down your throat — try to stop us.”

Rush Street Interactive taking a page from its rival DraftKings

If it works for your competitor, it just might work for you. That appears to be the mindset of Chicago-based Rush Street Interactive, as it too will become a publicly traded company once its deal with dMY Technology Group is complete.

Gambling Stocks

Rush Street has a tally of first-to-market achievements under its belt. It was the first company to launch online casino gaming in New Jersey and the first to launch online sports betting in Pennsylvania, Indiana, Colorado and Illinois.

According to the Chicago Business Journal, the transaction value of the combined companies will be around $1.78 billion. Once the transaction is complete, dMY Technology will change its name to Rush Street Interactive Inc. (RSI).

The move is not surprising and is a product of a rapidly changing industry looking to compete with top operators like DraftKings and FanDuel.

MGM Resorts and the value of investment

Investing In Online Gambling Stocks To Buy

Lastly, we have MGM Resorts and the 10-figure investment from billionaire Barry Diller due to the outlook on online gambling. Diller’s company, InterActive Corp, purchased a 12% stake in MGM worth around $1 billion.

In a Fox Business report, Diller said the online gambling industry is worth $450 billion on a global scale and he has been looking to enter the online space for some time.

The substantial investment helps reinforce the narrative that online gambling is where the industry is heading. New Jersey online casinos recorded $84.9 million in revenue for June. Pennsylvania netted $55.8 million, and some market analysts anticipate Michigan’s online gambling value to be worth more than either of them.

The US stock market is extremely volatile and continuously in flux. To that extent, it might be wise to stick with Thompson’s advice and back the Celtics. They swept Philly 4-0 and now take on the defending NBA ChampionToronto Raptors in a best-of-seven series beginning Thursday, Aug. 27.